Contact Us | (800) 584-6460 | legacy@earthjustice.org

Gifts That Pay You Income

Defend the planet you love while providing for yourself or loved ones

Is a life income gift right for me?

Do you want to make a meaningful gift to Earthjustice, turn assets into an income stream, and receive tax benefits today?

Learn more about:

Or contact us to explore the life income gifts that best align with your goals.

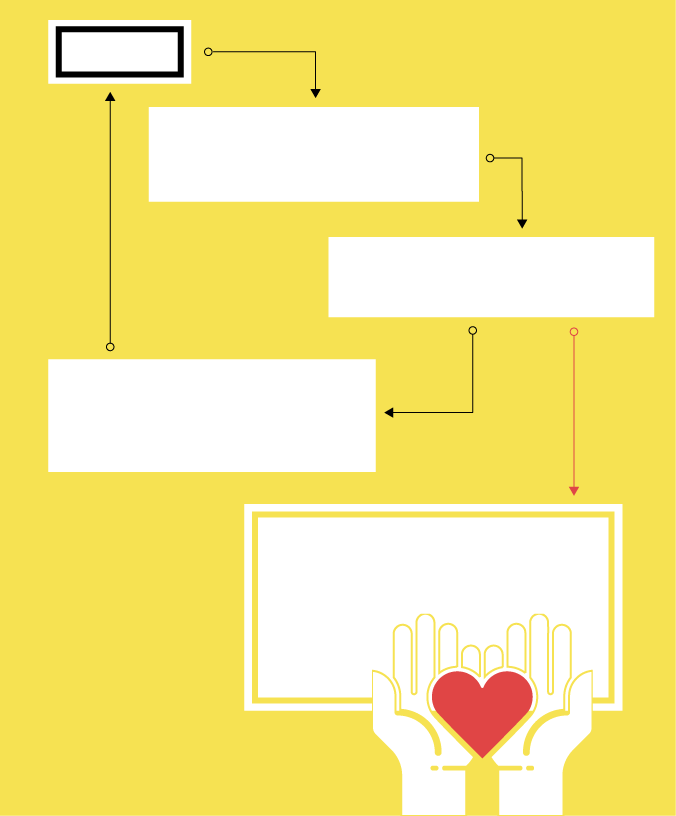

How life income gifts work:

You

Transfer cash, stocks, or other assets

Create a life income gift

Receive tax benefits and steady payments

Remaining balance donated to Earthjustice

Charitable Remainder Trusts

If you own a second home, rental property, or business property that you are ready to sell, but you’re worried about capital gains taxes, then creating a charitable remainder trust (CRT) with Earthjustice might be right for you.

How do Charitable Remainder Trusts Work?

You fund an irrevocable trust with a transfer of $100,000+ in cash or appreciated assets, and you receive an immediate charitable tax deduction for the projected value of your future gift. (See note below on gifts of real estate.)

- The appointed trustee then sells the transferred assets (paying no capital gains tax) and reinvests the proceeds in the trust.

- The trust pays you income for life or up to 20 years, depending on your preference. You can also select additional income beneficiaries.

- The payment rate is determined when you create the trust and is typically 5% of the trust’s value as calculated each year. As the trust’s value grows over time, your income increases.

- You may donate additional assets to your trust at any time.

- At the end of the trust’s term, the funds remaining are donated to Earthjustice, helping to advance our crucial legal and advocacy work.

Note on gifts of real estate:

- For trusts funded in whole or in part with real estate, the minimum is $500,000. View our Gifts of Real Estate brochure to learn more.

Benefts to You

With a charitable remainder trust:

- Receive an immediate tax deduction and avoid capital gains taxes.

- Convert the value of your appreciated assets into income for life or up to 20 years.

- Support Earthjustice’s mission to secure a sustainable future in which all communities thrive.

Charitable Gift Annuities

With a charitable gift annuity (CGA), you can make a significant gift to Earthjustice and receive dependable payments for life, plus immediate tax benefits.

How do Charitable Gift Annuities Work?

You make an irrevocable donation of cash, long-term appreciated securities, or mutual funds to Earthjustice. (See a new way to fund a gift annuity.)

- You decide whether you want your charitable gift annuity to benefit one or two people, which can include a spouse or other loved one. Our minimum gift is $10,000 for individuals or $20,000 for couples.

- You choose when you want your payments to start — right away or at a later date. You must be at least age 60 to receive payments. Deferring your payments for a year or more makes you eligible for a higher payment rate.

- Your payment rate is based on your age when your payments commence and will never change, no matter how long you live or how the market fluctuates. The older you are when your payments start, the higher your payments will be.

- A portion of your gift may qualify for an immediate charitable income tax deduction, and a portion of your payments may be treated as tax-free income. If you use stocks or other appreciated assets to create your gift annuity, you will avoid some capital gains taxes as well.

- After your lifetime, the remainder of your gift will support Earthjustice’s efforts to protect communities, wildlife, and the planet.

Benefts to You

With a charitable gift annuity:

- Lifetime payments that never change.

- You may avoid capital gains taxes when you use appreciated assets to fund your gift annuity.

- You may be eligible for an income tax deduction for the year you make your donation.

- Gift annuities are an ideal way to provide financial security to you and a loved one.

- You affirm your legacy of support for Earthjustice’s long-term legal objectives.

A New Way to Fund a Charitable Gift Annuity

Supporters aged 70½ or older may take a one-time qualified charitable distribution (QCD) of up to $54,000 from their IRA to fund a charitable gift annuity. There are a few differences between annuities funded with a QCD and those funded with cash or appreciated securities.

Please contact us to learn more about this giving opportunity.

Not sure where to start? Contact us!

The information on this page is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only.

- California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association.

- Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department.

- South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance. Please request our Gift Annuity Disclosure Statement for additional information.

Why We Give to Earthjustice

Why We Give to Earthjustice

“It’s a win-win for us and for Earthjustice.

“A gift annuity as a way of giving has lots of advantages. But most important, we get to further the important work of Earthjustice.

“Clean air, clean water … the laws are on the books. We have to protect them. And this is our way of doing all we can.”

Evergreen Council members & Earthjustice supporters